Return to Bretton Woods: A Global Solution to Runaway Inflation

Amid runaway inflation and major bank collapses, gold is reshaping the global monetary order once again as the safest hedge to the uncertainty

For anyone born, or even resident in the UAE, the year 1971 has special meaning. Commemorated as the foundation of the United Arab Emirates, under an initiative led by the late Sheikh Zayed bin Sultan Al Nahyan, 1971 was also a pivotal year for global culture, technology, and economics.

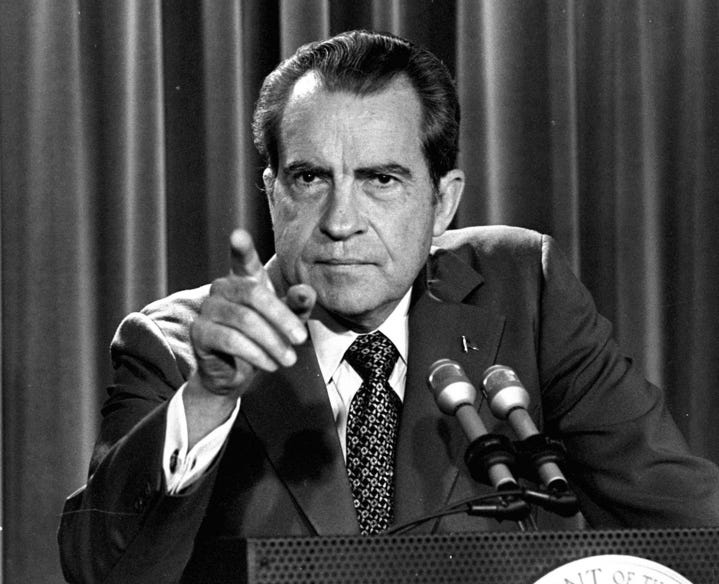

John Lennon released “Imagine”, Switzerland gave women voting rights in state elections, Intel released the world’s first microprocessor, Starbucks opened its first coffee shop and a new stock market index called the Nasdaq Composite made its debut. 1971 was also the year in which U.S President Richard Nixon initiated the changes that began to bring to an end the Bretton Woods System - a mechanism designed to prevent competitive devaluations and promote international economic growth by pegging the U.S dollar to the value of gold. In doing so, the Nixon administration intended on implementing price controls that would address the “international dilemma of a looming gold run and the domestic problem of inflation”, and in the short term, it worked. With the gold window closed, foreign governments were no longer able to exchange their dollars for gold, while a 90-day freeze on wages and prices brought down inflation without increasing unemployment or slowing the economy. In addition, a 10 per cent import surcharge protected domestic production from unfavourable exchange rates.

By reintroducing a ‘fiat’ system to the world’s reserve currency, other IMF members were free to choose any form of exchange arrangement they wished, outside of pegging to gold, leaving the creditworthiness and control of each currency to their respective governments. On the plus side, the return of fiat money provided greater stability by giving governments more flexibility in terms of responding to variables such as liquidity and interest, while supporting stronger leverage to protect economies from financial crises. It also enabled governments to increase the money supply, helping to stimulate economic growth, but at the same time, potentially causing serious inflation.

In a perfect storm of extended low-interest rates, aggressive government bond investments and equally aggressive interest rate hikes to tame inflation, the collapse of Silicon Valley Bank earlier this month, the biggest US bank failure since the global financial crisis in 2008, as well as the failure of Signature Bank, Silvergate, and what the FT’s Owen Walker has aptly referred to as the “shotgun marriage” of UBS effectively being forced into taking over Credit Suisse, has left many wondering which banks might be next, whether their money is safe and what is a smart store of value during this period of high volatility?

Certainly, if we were to look at the trends according to the World Gold Council report, demand for gold rose by 28 per cent y-o-y in Q3 2022 to 1,181 tons, with significant orders coming from the world’s central banks, once again emphasising the precious metal’s role as an effective inflation hedge. In fact, 2022 witnessed the most gold ever purchased in a single year since records began in the 1950s, with central banks alone shoring their stocks to the tune of $70 billion.

According to John Hathaway, CFA Managing Partner, Sprott Inc. & Senior Portfolio Manager, Sprott Asset Management USA. Inc, the recent appetite shown by the central banks may have more serious long-term implications. As quoted from a recent Sprott letter, Hathaway stated: “Dollar strength is a mirage. It is the reverse image of all other paper currencies’ weakness. In our view the dollar wrecking ball may well represent the last stand for paper currencies in general all of which are the ever-increasing issuance of fiscal decay.”

According to the DMCC-based, industry veteran, Jeff Rhodes, “Buying from the official sector in 2022 was the most on record in any one calendar year, and the signs are that the central banks are back in again, buying into any significant price weakness with gold anticipated to reach a fresh, all-time high in excess of $2100 this year,” – a statement very much supported by the recent announcement that The Bank of Russia has resumed disclosing the volume of monetary gold as part of Russia's international reserves. According to the Central Bank, at the beginning of March they amounted to 74.9 million ounces (2,330 tonnes) worth $135.6 billion,” as stated on Interfax.

Outside of speculation, gold’s appeal has been quietly supported from a regulatory standpoint too. Under Basel III, banks have a capital requirement of seven per cent, which can be used as a buffer under financial stress. Included in this provision are High Quality Liquid Assets (HQLA), or assets that are considered highest quality in the banking system, of which gold is included providing it is hedged in the futures market. As summarised by Rob Kientz, “I believe it is very possible that as we get closer to the next financial collapse, which I don’t expect to be too long now, that banks and financial houses rush into the gold market and buy up whatever metal liquidity they can find. In fact, buying could be much higher this time because I expect the dollar and US bond system to come under extreme pressure during the next financial crisis.”

That being said, several investors warned against following the trend, without critical analysis. According to Gary Watts, VP, financial advisor at Wealth Enhancement Group, "Other investors and institutions may have already done the same thing, which generally results in higher prices. Second, the ideal time to build and allocate a model portfolio would be in less volatile and stressful times when emotions aren't controlling decision-making. Sailors outfit and provision their boats before the storm."

Contrary to this, others believe that “gold will be the best investment in 2023.” Following his compelling keynote speech at last year’s DMCC Dubai Precious Metals Conference, Peter Schiff remains bullish, thanks to several factors.

“Obviously, I’ve been bullish for a while. But I’m even more bullish now to the extent that’s possible, based on what’s been happening. We’re going to be living in a high-inflation environment for the foreseeable future. Rates are not going back down to zero, but they’re still going to be negative in real terms.”

More speculatively, founder and chairman of Casey Research, Doug Casey commented, “Because there will be serious talk of remonetizing it; BRICS don’t want to use the dollar—and for good reason. The public, who’ve forgotten gold even exists, will start buying it, driven by fear—fear of currency debasement, and fear of counterparty risk in the financial markets. So physical gold is going to do really well in 2023. And gold miners will do even better.”

Referencing the BRICS nations talks of creating their own reserve currency to reduce dependence on the US dollar, euro and the IMF’s Special Drawing Rights (SDRs) currency, the new reserve will likely be based on a basket of the currencies of the emerging economies of Brazil, Russia, India, China and South Africa, with countries including Egypt, Turkey, Algeria and most recently Saudi Arabia also showing interest. Based on the fact that the gold rally cited by the World Gold Council was primarily bought up by the central banks of the same countries, it isn’t unthinkable that the new currency could be gold-backed, and at the very least, certainly shows a willingness to diversify out of dollars.

As acutely summarised by Philip Pilkington, “Perhaps there is no plan behind the current gold rush, but it may be read in retrospect as the beginning of the evolution of a new global monetary order. It could be the first step toward this reshaping of the landscape, as countries around the world try to find alternatives to the dollar. The West is learning a hard and fundamental lesson: financial systems are built on trust, and if they are weaponised, they lose the trust required to maintain their dominance.”

According to NASDAQ, “The BRICS+ group has good longer-term economic and political incentives for reducing the dollar’s global dominance. BRICS countries account for 40% of the global population and one-third of the world economy on purchasing-power-parity terms. With Saudi Arabia, BRICS would have two of the largest oil producers, Saudi Arabia, and Russia, and two of the largest oil consumers, China, and India, increasing the potential to price mutual oil sales in local currencies.”

Even independently of BRICS, mention of a “Golden Ruble 3.0”, has already been established by credible sources, citing Russia’s trade surplus, the growing trend of settlements in “soft” currencies and Russia’s status as the third country to use the yuan for international payments. According to Russian media, the yuan/ruble pair on the Moscow Exchange has already overtaken the dollar/euro in terms of daily trading volume.

That being said, any situation that might lead to the long-term demise of the petrodollar could act as a catalyst to walk back US policy and return to the gold standard, thereby preventing a weakened position on the global stage, whilst protecting the US dollar’s status as the world’s reserve currency. After all, the US remains the world’s largest bullion holder with more than 8,000 tons in reserve – roughly the same amount as the next three highest reserve nations combined.

Ultimately, no matter the outcome, the likelihood is that gold will be, at the very least, a safe investment, and potentially a strong performer and while it may not offer the sort of massive upsides of a buoyant equities market, it has remained a consistent store of value.

Whether gold may yet play a more significant role in our collective financial future, as a growing list of nations gravitate towards a more equitable climate less governed by a weaponised dollar, or as a shield of last resort for US hegemony remains to be seen.

Good read thanks. Was the year of my birth too.

Great Read