Dubai’s gold business is heading towards a defining moment – and it is not just one reason only

What Dubai does not require is being selectively targeted by some global entities

Taking place under the theme ‘The Future of Precious Metals: Global Governance to Trade Trends’, the 2023 Dubai Precious Metals Conference (DPMC) welcomed industry leaders from around the world.

These includes the finance and precious metals expert and best-selling author Jim Rickards; the World Gold Council head of Middle East and public policy Andrew Naylor; and LBMA executive board director and general counsel Sakhila Mirza.

Returning in its 11th year, and hosted at SO/Uptown Dubai, the DPMC united key stakeholders to discuss some of the industry’s prevailing challenges and opportunities, while addressing the role of precious metals in an increasingly volatile geopolitical landscape.

As John Reade, market strategist, World Gold Council, stated, gold’s greatest strength is its diversity. According to recent data from the WGC, “Central banks have loaded up on more gold than previously thought, offering crucial support to prices that have faced pressure from global monetary tightening. Countries expanded bullion reserves by 337 tons in the three months through September.”

This added to the record-breaking 125 tons acquired by central banks in the first two months of the year. It is, therefore, easy to see how large-scale physical trade has accounted for approximately 18 per cent of the market.

Other growing segments include tech, which today accounts for about 7 per cent of the market. At the same time, its extensive liquidity is clearly illustrated through daily trading volumes to the tune of $150 billion.

Certainly, the bullish acquisition strategies of central banks have only added credibility to the rumour of a gold-backed currency to rival the US dollar, while ongoing, western-led sanctions against Russia have supported greater trade flows to Dubai and, more recently, Hong Kong.

In this, there are two lessons:

The rapidly shifting tide of today’s geopolitical landscape ought to remind commodity-focused businesses that your country of incorporation may mean your requirement to support its politics involuntarily. Recent examples of entities falling foul include the 127 British companies who disclosed sanction violations, or in the case of accessibility, Venezuela’s failed appeal to control $1.95 billion of its gold reserves, currently held at the Bank of England.

Inconsistencies with targeted sanctions. As highlighted, off the record, by a partner of a Dubai-based gold refinery, “The recent sanctions imposed by the UK government on a UAE-based gold trader, as part of a broader strategy to disrupt Russia’s economic power, underscore a significant shift in the global gold trade dynamics.

“While these targeted sanctions, as per the National Crime Agency's Red Alert on gold sanctions circumvention, are commendable in their intent to stop Russia's war efforts in Ukraine, they also bring to light a landscape filled with inconsistencies and transparency issues.

Primarily, the impact of these sanctions on the global gold trade cannot be understated. Entities linked to the UK jurisdiction will now tread more cautiously and hesitate to touch any gold that traces back to Dubai.”

“Primarily, the impact of these sanctions on the global gold trade cannot be understated. Entities linked to the UK jurisdiction will now tread more cautiously and hesitate to touch any gold that traces back to Dubai.

“However, this scenario of Russian gold being melted and recast, and its origins obscured, is not unique to the UAE. Hong Kong and Turkey, too, have been importing substantial amounts of Russian gold.

“Notably, Hong Kong's imports surged by 750 per cent to about $4.3 billion from January to September 2023.

“Yet, the UK’s laser focus on the UAE, while leaving actors in Hong Kong untouched, raises questions about the fairness and effectiveness of these sanctions.”

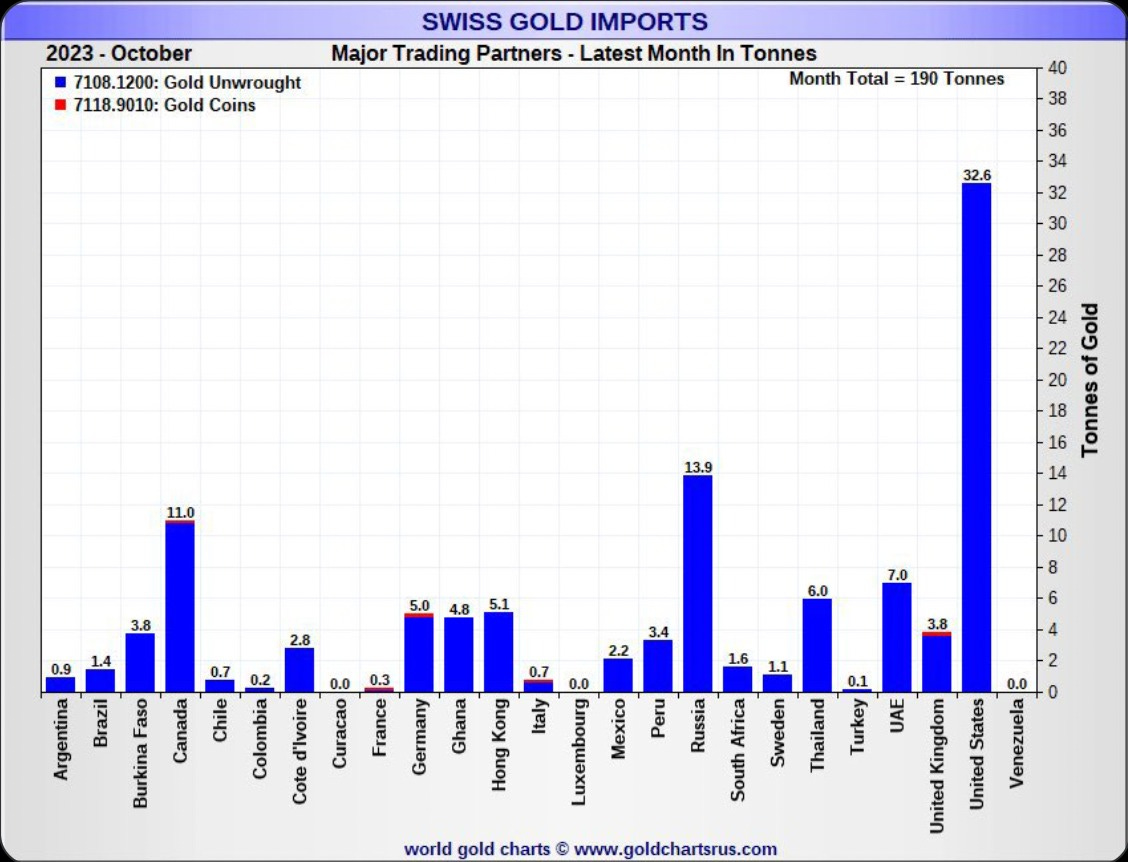

As acutely spotted by Bullion Star, “Strangely, the financial media hasn’t yet commented on the large amount of Russian gold imported into Switzerland during October.”

Whether a BRICS+ gold-backed currency was to move ahead or not, the trading bloc’s strategic area gives good reason to suggest a change in the global order.

As illustrated by Jim Rickards during his keynote address, referring to Halford John Mackinder’s ‘Democratic Ideals and Reality’ - “Who rules East Europe commands the Heartland; who rules the Heartland commands the World-Island; who rules the World-Island commands the world.”

In addition to China and Russia’s status as the world's first and second largest gold producers, supported by Brazil and Indonesia in the top ten, BRICS+ will remain a precious metals powerhouse from mining to consumption and everything in between.

UAE-India CEPA does its part

Where the UAE is concerned, its location between east and west as well as its infrastructure, logistics, financial services, and quality standards have made it thoroughly advantageous, particularly for India. Since entering into the UAE-India CEPA in May 2022, the reduction and removal of tariffs has supported the anticipated export of 140 tons of gold from the UAE to India during the period 2023-24.

Structured to accelerate bilateral trade and investment across a range of sectors - including goods, services and investment - the mutually beneficial partnership has helped to support the UAE’s position as a gold centre while providing much-needed material for India’s burgeoning middle-class, which today is estimated to exceed half a billion people.

In addition, the alignment of UAE Good Delivery as an exemplar for responsible sourcing has also enhanced the level of trust placed in the UAE by the international markets, courtesy of its high standards in compliance. A case in point, the UAE Good Delivery’s recognition by the India International Bullion Exchange.

Gold’s blockchain exposure

Aside from its trade and regulatory advantages, the UAE has also flourished in tech. Last year, the DMCC entered into two partnerships with Web3 firms that saw the tokenisation of physical gold backed up by DMCC’s Tradeflow platform.

As a result, 145 kilograms of gold were traded within the last 12 months. As highlighted during the conference, technological advancement has also opened the doors to various types of utility.

Keith Weiner, founder and CEO of Monetary Metals, explained how his business leases gold to provide a yield to investors while offering competitive financing to businesses. The Qenta Inc chief administrative officer, Nirali Shah shared how her company ‘combines next-generation global payments and embedded finance offerings with transformative blockchain technology to create an integrated ecosystem where data and value flow seamlessly in a compliant and trusted way’.

This includes its flagship G-Coin token product, which offers consumers a digital title to actual, physical, responsibly sourced gold that is tracked on blockchain as it moves from mine to vault, while suppliers meet ESG best practices.

As stated by Thani bin Ahmed Al Zeyoudi, UAE Minister of State for Foreign Trade, “The UAE has established itself as a critical link to every gold market in the world.” A statement supported by the broad cross-section of attendees of this year’s conference.

Next step – UAE banks and gold

As with any sector, there will always be room for improvement. As highlighted by Jeffery Rhodes in his closing remarks on the gold finance panel: “While progress has been made by the leading banks in the gold sector, there is significant scope for cross-border, gold and silver based financing.

“However, this will require UAE banks to be able to physically import/export UAE/LBMA accredited gold and silver bars to really facilitate the development of a regional bullion banking industry to match the big banks in the US, Europe and Asia.”

Overall, I consider the outcomes of this year’s conference as an affirmation of the UAE’s wider, sectorial leadership. I am confident that through the efforts of entities such as the Ministry of Economy’s Anti-Money Laundering department, through to enhanced cooperation with other gold centres such as London, particularly the LBMA’s responsible sourcing of recycled gold, eliminating cash transactions and supporting a legitimate ASM economy, the UAE will continue to rise to the occasion.

Most importantly, by facilitating an impartial, business environment that focuses on collective, industry improvement, we, as stakeholders have the power to provide an antidote to the divisive, geopolitical policies that have upheld opaque practices and inconsistencies for far too long. As highlighted by Ronald-Peter Stöferle, managing partner and fund manager of Incrementum AG, people turn to gold out of “a distrust of sovereign currency.” - A statement worth remembering as the world starts to seriously reassess the nature of money and who controls it.

Well written Don Sul. I look forward to engage you for more insights on the Gold Market especially Gold which originates from Africa and how we can make the Dubai, the ideal destination for African Gold and its trade.